2024 March Calendar Blank Form Irs

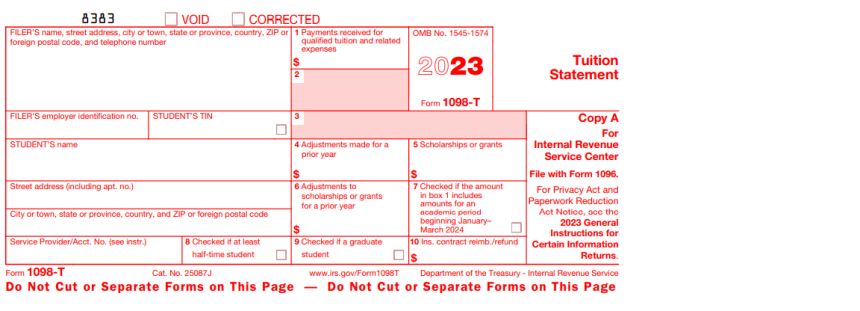

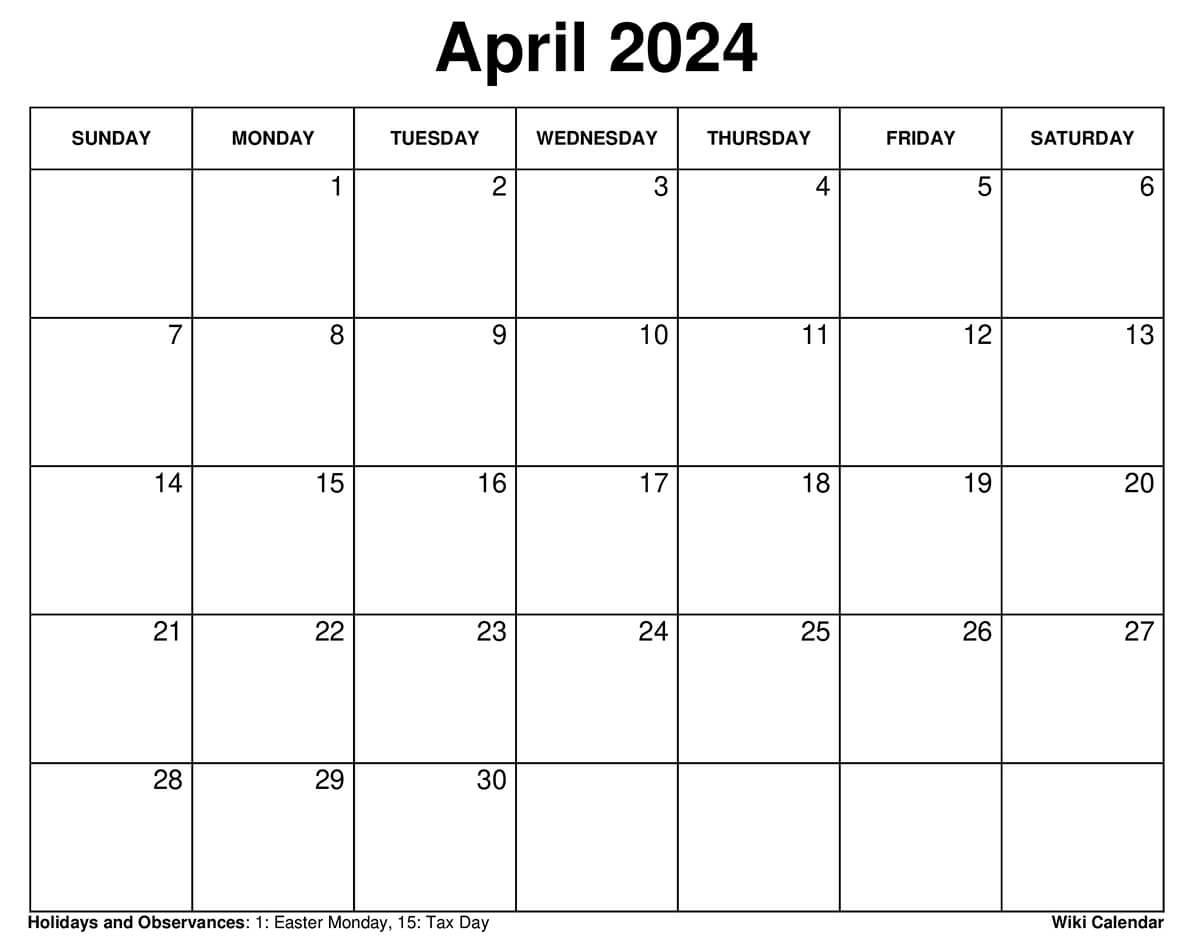

2024 March Calendar Blank Form Irs – are required to file and furnish a 1098-T Form to students whose payments for qualified paid tuition and related expenses were received in the 2023 calendar year. The information being reported to the . A 1099 tax form by the IRS. Deadlines for the most common 1099 forms include: 1099-NEC: Jan. 31 for both paper and electronic filers. All other 1099s: Feb. 28 for paper filers and March .

2024 March Calendar Blank Form Irs

Source : www.irs.gov

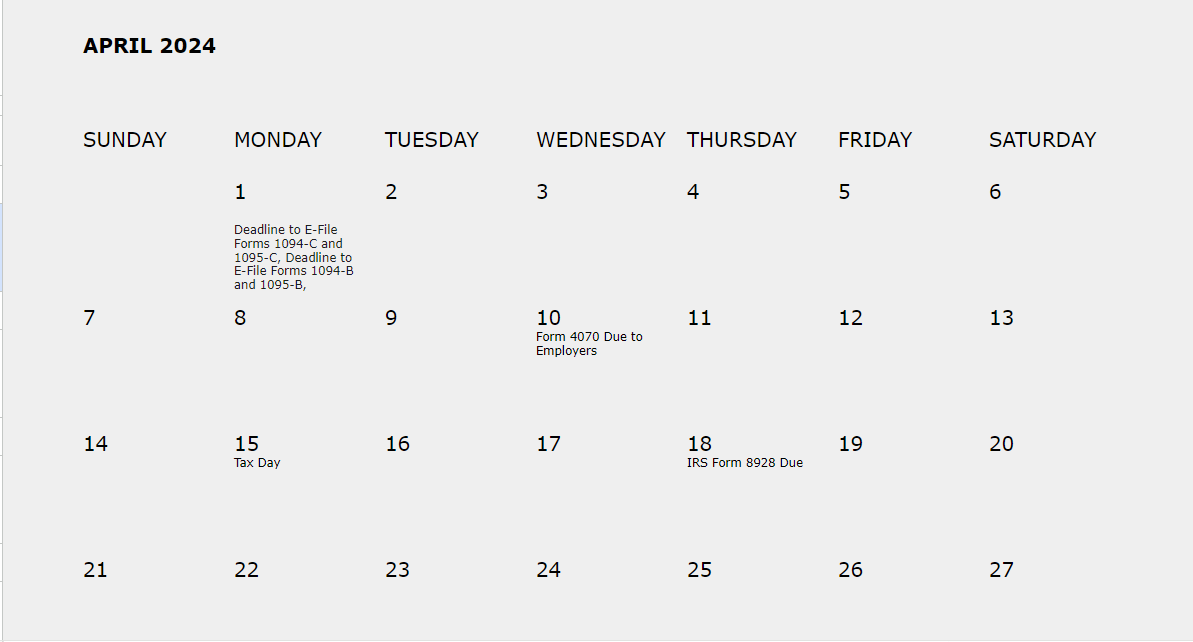

2024 HR Compliance Calendar [Free Download]

Source : fitsmallbusiness.com

The Ultimate HR Calendar for 2024: Holidays, Compliance, & More

Source : verifiedfirst.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Printable April 2024 Calendar Templates With Holidays

Source : www.wiki-calendar.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Tax Information | Roger Williams University

Source : www.rwu.edu

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Printable April 2024 Calendar Templates With Holidays

Source : www.wiki-calendar.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

2024 March Calendar Blank Form Irs 3.11.13 Employment Tax Returns | Internal Revenue Service: 11. The new revision is dated December 2023. Form SS-8 was last revised in May 2014. Updated instructions were released March 21 and have a March 2023 revision date. . An employer is treated as having experienced a significant decline in gross receipts for a calendar quarter 11:59 P.M. local time on March 22, 2024. According to FAQs posted on the IRS’s website, .